- Tokenized

- Posts

- Crypto Powered Banks, While Banks Want Crypto

Crypto Powered Banks, While Banks Want Crypto

Dakota have raised $12.5m Series A to build an ‘Internet era bank’, amidst the backdrop of banks launching crypto products. AND... Monad Foundation acquire Portal.

If you're reading this and still haven't signed up, click the subscribe button below!

Introduction

Welcome to the Tokenized newsletter, brought to you by the creators of the Tokenized Podcast; Simon Taylor of Fintech Brainfood and Pet Berisha of Sporting Crypto, written by Jeremy Batchelder.

We are the newsletter for institutions that need help preparing for a Tokenized future.

We run through the headlines every week, what it means for you and a market readout. Always with an institutional, business-focused perspective.

Join us every week as we meet your Tokenization needs.

Stories You Can't Miss 📰

🚀 Monad Foundation Acquires Stablecoin Infrastructure Project Portal

The Monad Foundation has exclusively announced its acquisition of Portal, a stablecoin infrastructure provider, as the testnet prepares for mainnet launch.

Key Points:

Portal will continue operating as an independent entity while leveraging Monad's technology to serve customers

Portal founder Raj Parekh transitions to Head of Payments and Stablecoins at Monad Foundation

Financial terms were not disclosed, but the acquisition aims to grow the "onchain economy" and make Monad the "blockchain of choice" for stablecoin transactions

Monad mainnet launch is described as coming "very soon" though specific timing remains undisclosed

The teams will collaborate on bridges and stablecoin wallets, capitalizing on natural synergies between their technologies

The Tokenized Take:

Perfect timing for stablecoin infrastructure: With stablecoins emerging as the defining narrative of 2025 and regulatory support strengthening, acquiring Portal positions Monad to capitalize on the maturation of payment infrastructure

M&A momentum continues: This acquisition adds to the rising trend of crypto M&A activity, particularly in financial sector projects, signaling healthy consolidation and sector heating up

Strategic positioning for mainnet: By acquiring proven stablecoin infrastructure before mainnet launch, Monad can immediately offer enterprise-grade payment solutions rather than building from scratch

Focus on "boring but profitable" use cases: Portal's emphasis on traditional banking and payment use cases aligns with the industry shift toward practical, revenue-generating applications over speculative trading

Global payments ambition: The partnership aims to "push the limits of what's possible in terms of money moving globally," targeting the massive cross-border payments market where stablecoins are gaining significant traction

💳 Dakota Raises $12.5M Series A to Build "Internet Age" Business Banking

Crypto-integrated business banking platform Dakota has secured $12.5 million in Series A funding led by CoinFund to accelerate its mission of building globally accessible business banking using stablecoins and U.S. Treasuries.

Key Points:

Founded by veterans from Coinbase, Square, and Airbnb, Dakota enables businesses to hold and transfer funds in USD or stablecoins while accessing traditional payment rails (ACH, Fedwire, SWIFT, SEPA)

Since launching in 2023, Dakota has attracted over 500 business customers processing billions in annualized transaction volume, with funds backed 1:1 by U.S. Treasuries

The platform recently expanded to 100+ jurisdictions and added corporate cards, operating like a typical fintech app with blockchain complexity abstracted away

The Tokenized Take:

Perfect regulatory timing: With the GENIUS Act gaining bipartisan support and global stablecoin frameworks advancing, Dakota is positioned to benefit from emerging regulatory clarity while recent acquisitions by Stripe and PayPal's stablecoin launch validate the mainstream acceptance of this infrastructure

Superior risk and UX model: By backing deposits 1:1 with U.S. Treasuries rather than fractional banking, Dakota eliminates the counterparty risks highlighted by Silicon Valley Bank's collapse while providing familiar banking interfaces that abstract away crypto complexity for Web2 businesses

Global dollar access thesis: Dakota's mission to give businesses from "Bogotá to Bangalore" the same U.S. dollar banking access as San Francisco startups taps into massive underserved demand for dollar-denominated financial infrastructure in a world where business is increasingly borderless

Traditional Banks are mobilising: We’ve seen recently BBVA offer crypto products, and there are more to come. Now we’re seeing crypto-native greenfield banks

Stablecorner ⚖️ → From Chain Theatre to Real Solutions

The stablecoin infrastructure landscape is experiencing a fundamental reckoning as the market moves from speculative "chain theatre" toward genuine problem-solving applications. As revealed in this week's Tokenized podcast discussion, we're witnessing the end of an era where building yet another blockchain was a viable business strategy.

The Bullshit Detection Era Has Arrived

Haonan Li from Codex delivered a blunt assessment: "Historically saying that you're building a chain is sort of the easiest cop-out you can have in crypto because the valuations are so large... If you look at a website and they say they're building a chain, but all of it is gobbly gook or it's word salad, or it says things like purpose built for developers... then I think people smell bullshit."

This market maturation coincides with a critical insight about how traditional businesses actually approach blockchain adoption. Portal's Raj Parekh noted that Web2 developers "have likely never touched a block explorer. Don't know what RPCs are. They're not crypto devs by any means and so they have no pre-existing bias at all." The implication is clear: winning strategies focus on solving business problems, not showcasing technical features.

The Vertical Integration Solution

The response to this challenge is emerging through vertical integration strategies that own the entire customer experience. As Oli Harris from Arda explained: "You actually want to go build your own first party apps and then drive down to the technology... You need to actually own the app through the tooling into the protocol and then abstract away the backend."

This approach directly addresses what Harris calls the "infrastructure to nowhere" problem—building platforms without clear use cases or customer adoption paths. Instead of hoping developers will discover novel applications for general-purpose infrastructure, successful players are identifying specific pain points and building complete solutions.

Network Effects Trump Technical Specifications

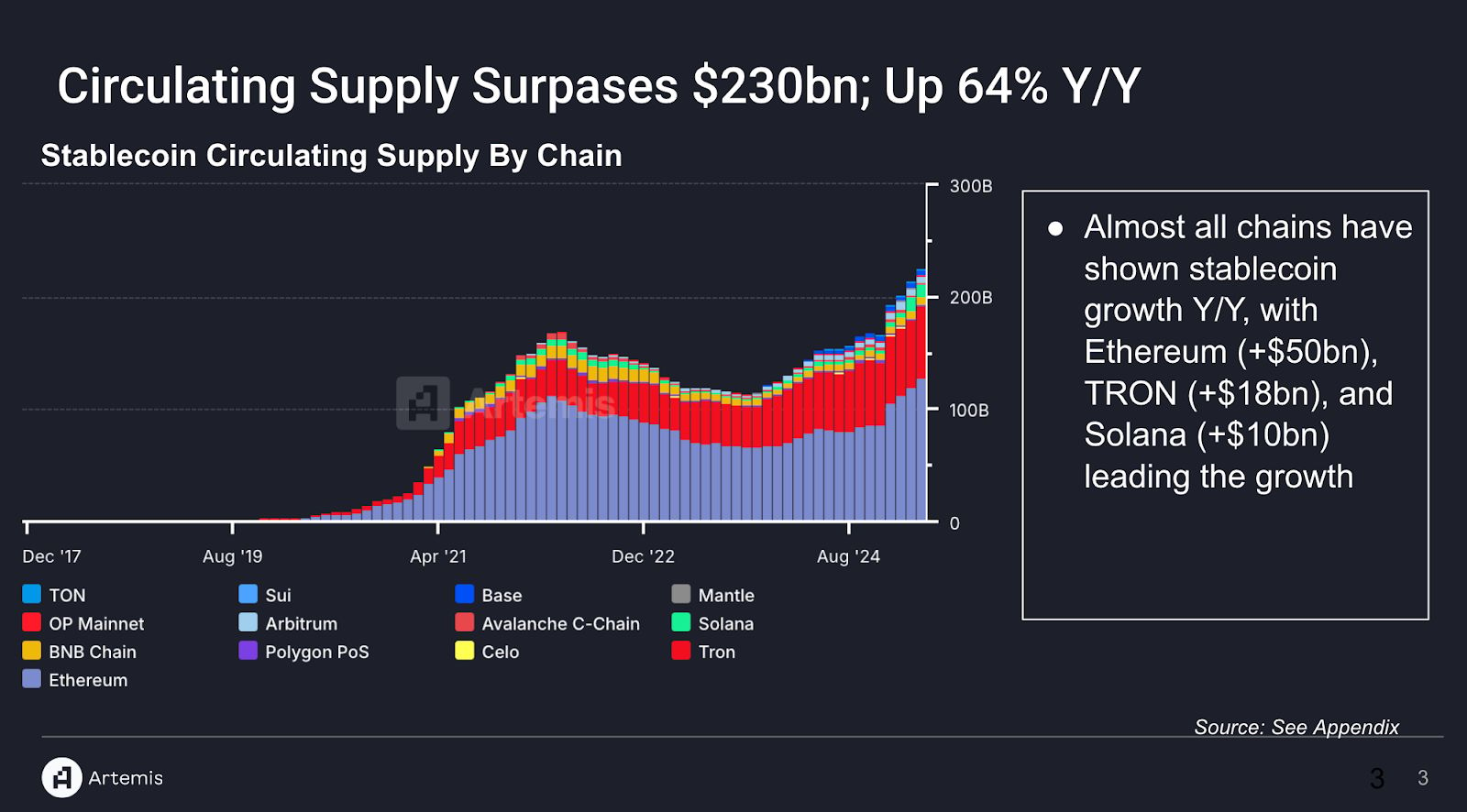

The current stablecoin distribution validates this use case-first approach. While USDC exists on 23 blockchains and USDT on nine, 90% of stablecoin supply remains concentrated on just three chains: Ethereum, Tron, and Solana. Tron's persistence despite higher fees demonstrates that established liquidity and user networks create moats that technical superiority alone cannot overcome.

The Path Forward: Problems First, Infrastructure Second

This evolution suggests that the next wave of stablecoin infrastructure success will come from companies that start with real-world problems and work backward to the necessary technology stack. Whether it's Monad's acquisition of Portal for payment solutions, banks like BBVA integrating crypto trading, or specialized chains like Codex focusing on fiat-crypto bridging, the winners are those building complete solutions rather than hoping someone else will find applications for their infrastructure.

The era of "build it and they will come" blockchain development is ending. The era of "solve it and they will pay" has begun.

📰 Some More News:

🏦 Tokenization, Stablecoins & Finance

Crypto exchange OKX joins Global Dollar Network, integrates Paxos-issued USDG stablecoin (Read more here)

Decentralized lender Aave surpasses $50 billion in net deposits (Read more here)

Revolut chooses Morpho for its DeFi yield offer (Read more here)

Ripple plans RLUSD stablecoin EU entry via Luxembourg (Read more here)

Bank of England boss warns banks against issuing stablecoins amid global scrutiny (Read more here)

HSBC completes e-HKD trials of CBDC on public blockchains (Read more here)

Jack Ma-Backed Ant to Add Circle’s Stablecoin to Global Net (Read more here)

Standard Chartered says stablecoins overshadowed bitcoin in discussions; $750 billion market size could trigger macroeconomic shifts(Read more here)

🤑 Funding and M&A

💼 Government & Policy

Tweet of the Week 🐤

From Artemis

Thanks so much for reading the Tokenized Newsletter!

Please share this edition or share it with your colleagues if you enjoyed it!

Disclaimers

This newsletter is for informational purposes only and is not financial, business or legal advice. These thoughts & opinions and do not represent the opinions of any other person, business, entity or sponsor. Any companies or projects mentioned are for illustrative purposes unless specified.

The contents of this newsletter should not be used in any public or private domain without the express permission of the author.

The contents of this newsletter should not be used for any commercial activity, for example - research report, consultancy activity, or paywalled article without the express permission of the author.

Please note, the services and products advertised by our sponsors (by use of terminology such as but not limited to; supported by, sponsored by, Made Possible by or brought to you by) in this newsletter could carry inherent risks and should not be regarded as completely safe or risk-free. Third-party entities provide these services and products, and we do not control, endorse, or guarantee the accuracy, efficacy, or safety of their offerings.

It's crucial to provide our readers with clear information regarding the inherent nature of services and products that might be covered in this newsletter, including those advertised by our sponsors from time to time. When you buy cryptoassets (including NFTs) your capital is at risk. Risks associated with cryptoassets include price volatility, loss of capital (the value of your cryptoassets could drop to zero), complexity, lack of regulation and lack of protection. Most service providers operating in the cryptoasset industry do not currently operate in a regulated industry. Therefore, please be aware that when you buy cryptoassets, you are not protected under financial compensation schemes and protections typically afforded to investors when dealing with regulated and authorised entities to operate as financial services firm.