- Tokenized

- Posts

- GENIUS Act: A Watershed Moment in Finance History

GENIUS Act: A Watershed Moment in Finance History

And... Base launches Base App

If you're reading this and still haven't signed up, click the subscribe button below!

Introduction

Welcome to the Tokenized newsletter, brought to you by the creators of the Tokenized Podcast; Simon Taylor of Fintech Brainfood and Pet Berisha of Sporting Crypto, written by Jeremy Batchelder.

We are the newsletter for institutions that need help preparing for a Tokenized future.

We run through the headlines every week, what it means for you and a market readout. Always with an institutional, business-focused perspective.

Join us every week as we meet your Tokenization needs.

Stories You Can't Miss 📰

🚀 Coinbase Launches Base "Super App" - A Web3 Game Changer

Coinbase has unveiled Base, a revolutionary "super app" that could finally make Web3 accessible to mainstream users beyond crypto enthusiasts.

Key Points:

Seamless user experience: Unlike previous crypto apps, Base looks and behaves like familiar mainstream apps with X-like social networking, trading, and payments all in one interface

Apple Pay integration: Critical breakthrough allowing users to add USDC stablecoin funds directly through Apple Pay, eliminating traditional crypto wallet friction

Portable blockchain identity: Offers a sovereign web identity that users control themselves, potentially competing with Google/Facebook sign-ins while maintaining data ownership

Base Pay with incentives: 1% cashback on USDC purchases and integration with Shopify (whose CEO sits on Coinbase's board) signals serious e-commerce ambitions

The Tokenized Take:

Mainstream crypto adoption catalyst: Base could be the first crypto app that non-crypto users actually want to use daily, bridging the gap between Web2 convenience and Web3 ownership

Revenue diversification for Coinbase: Beyond traditional trading fees, Base creates new income streams through USDC stablecoin interest and payment processing

Stablecoin infrastructure play: By making USDC easy to use for everyday payments, Coinbase positions itself to capture growing stablecoin payment flows

Early traction signals: 1.6 million livestream viewers and a young demographic at the LA launch suggest strong initial interest, though mainstream adoption remains to be proven

💼 Trump Signs Historic "Genius Act" Stablecoin Bill Into Law

President Trump has signed the landmark Genius Act stablecoin legislation into law, creating the first comprehensive federal regulatory framework for dollar-pegged cryptocurrencies.

Key Points:

Watershed moment for crypto: The bill marks the culmination of years of industry lobbying and represents the first major federal legislation providing clear, enforceable rules for stablecoins

CFTC oversight expansion: The legislation significantly expands the Commodity Futures Trading Commission's regulatory authority over the digital asset industry, bringing institutional-grade oversight

Bipartisan Congressional support: Strong bipartisan backing signals broad political consensus on the need for regulated stablecoin infrastructure in the U.S. financial system

Presidential signature complete: President Trump has now signed the bill into law, making it official federal policy and removing years of regulatory uncertainty

The Tokenized Take:

Regulatory clarity unlocks institutional capital: Clear federal rules remove the compliance uncertainty that has kept many traditional institutions on the sidelines of stablecoin adoption

U.S. dollar dominance reinforced: By creating a robust regulatory framework for USD-backed stablecoins, the legislation strengthens the dollar's position in the global digital economy

Corporate treasury integration: The law paves the way for compliant, bank-backed digital money solutions that can integrate with corporate treasury operations

Consumer protection foundation: Enforceable rules provide the trust and transparency needed for mainstream adoption while protecting retail users from unregulated offerings

💸 Stablecorner ⚖️ → GENIUS Act Redefines Everything: Winners and Losers

This is a summary of Austin Campbell's excellent analysis from Zero Knowledge Consulting on the GENIUS Act's passage and its market implications.

We highly recommend checking out his full article for the complete breakdown and fascinating behind-the-scenes details.

Campbell argues that the GENIUS Act represents a complete reshuffling of the financial landscape that will create clear winners and losers across traditional finance and crypto.

The Big Winners

Big Banks with Vision: He believes institutions like JPMorgan, Bank of America, and Citi are positioned to dominate if they act quickly. Stablecoins need treasury collateral, traditional banking rails, and custody services—all areas where major banks excel. However, he warns they need to hire crypto natives into risk and legal functions: "If you are a senior executive at a large bank and you think you have the talent in house, you don't."

Small Specialist Banks: Campbell predicts agile community banks can capture significant market share by moving faster than their massive counterparts. Unlike big banks that have been "complete jerks" to crypto companies, smaller institutions can build trust and provide 24/7 banking services.

Asset Managers: He expects firms like BlackRock to see massive fee growth as stablecoins generate billions in assets under management.

The Surprising Losers

Tether and Circle: Despite being market leaders, he argues both face existential challenges. Campbell sees Tether's opacity becoming a liability when competing against the "combined might of the entire US financial system," while Circle's dependence on Coinbase creates a critical single-point-of-failure.

Legacy Payment Networks: He compares Visa and Mastercard to Borders facing Amazon, arguing winners will focus on great UI/UX rather than centralized rails with "walled garden level fees."

The Human Rights Revolution

Campbell argues well-regulated USD stablecoins will be "one of the largest expansions of human rights in the past 50 years," giving citizens worldwide an escape route from corrupt banking systems. His message to dictators: "You have to either behave better, or people will flee the system."

Original analysis by Austin Campbell, Zero Knowledge Consulting

📰 Some More News:

🏦 Tokenization, Stablecoins & Finance

Crypto Finance and Avalanche Expand Regulated Access to AVAX for Institutional Investors (Read more here)

Citigroup weighs issuing stablecoin to expand digital payment capabilities: Reuters (Read more here)

PayPal appears to add Arbitrum support for PYUSD stablecoin alongside Ethereum and Solana, website terms show (Read more here)

Some big US banks plan to launch stablecoins, expecting crypto-friendly regulations (Read more here)

Perana Announce Their New Stablecoin - USD’ (Read more here)

DBS Bank launches blockchain-based programmable rewards (Read more here)

Charles Schwab leans into crypto, stablecoins. Tokenization: not so much (Read more here)

Ethena Foundation to spin up SPAC called StablecoinX dedicated to buying millions worth of ENA (Read more here)

Western Union explores stablecoin rollout in digital wallet amid industry optimism: Bloomberg (Read more here)

Stablecoins emerge as alternative: Amex CEO (Read more here)

Coinbase launches CFTC-regulated perpetual futures for US traders amid growing crypto regulatory clarity (Read more here)

Aave DAO approves Kraken-backed Ink Foundation to launch white-label version of lending protocol in ARFC vote (Read more here)

🤑 Funding and M&A

Citi-backed crypto infrastructure firm Talos acquires Coin Metrics in deal worth over $100 million (Read more here)

dYdX Acquires Pocket Protector (Read more here)

Polymarket plans to re-enter US with acquisition of derivatives exchange QCEX (Read more here)

Archax to Acquire Deutsche Digital Assets, Expanding Crypto ETP Reach in Europe (Read more here)

BitGo Files to Go Public as Crypto Market Surges Past $4 Trillion (Read more here)

💼 Government & Policy

Simon’s Market Readout 💬

A pixelated Simon gives you his market readout for the week.

The passing of the GENIUS Act is a genuine watershed moment for financial services. People who were previously lobbying against it, highly skeptical of crypto, now live in a world where stablecoins have a regulated perimeter in the United States law signed by the United States President.

This has shifted the calculus, one could argue, perhaps a little too late.

It shifted what your default strategy needs to be as a financial institution or as a payments company. This is no longer an experimental thing that could happen in the future. You need a strategy for it - it's now something you need to react to.

Large Fortune 500 treasuries, large Fortune 500 companies, and large financial institutions are all trying to figure out what their play is here.

How do they make it safe and secure for their customers?

How do they profit from the upside?

How do they make gains in market share?

How do they defend existing market share?

If you're not asking these questions, you should be.

I see this in my day-to-day interactions. People who were previously trying to tear down the very idea of a stablecoin are now promoting the importance of strong compliance, strong frameworks for defence, and the fact that this will need to be backwards compatible with everything you already have. And I agree with all of those points. If you are an institution with meaningful volumes, you can't go lightly into stablecoins thinking they're going to fix all of your problems. You've got to understand that there are net new risks here that you have to solve.

So my point isn't that this will be easy or that this will be hard.

My point is that the ground has shifted, and you need to adjust accordingly.

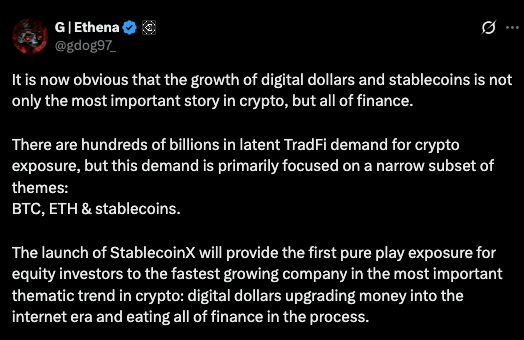

Tweet of the Week 🐤

From G | Ethena

Thanks so much for reading the Tokenized Newsletter!

Please share this edition or share it with your colleagues if you enjoyed it!

Disclaimers

This newsletter is for informational purposes only and is not financial, business or legal advice. These thoughts & opinions and do not represent the opinions of any other person, business, entity or sponsor. Any companies or projects mentioned are for illustrative purposes unless specified.

The contents of this newsletter should not be used in any public or private domain without the express permission of the author.

The contents of this newsletter should not be used for any commercial activity, for example - research report, consultancy activity, or paywalled article without the express permission of the author.

Please note, the services and products advertised by our sponsors (by use of terminology such as but not limited to; supported by, sponsored by, Made Possible by or brought to you by) in this newsletter could carry inherent risks and should not be regarded as completely safe or risk-free. Third-party entities provide these services and products, and we do not control, endorse, or guarantee the accuracy, efficacy, or safety of their offerings.

It's crucial to provide our readers with clear information regarding the inherent nature of services and products that might be covered in this newsletter, including those advertised by our sponsors from time to time. When you buy cryptoassets (including NFTs) your capital is at risk. Risks associated with cryptoassets include price volatility, loss of capital (the value of your cryptoassets could drop to zero), complexity, lack of regulation and lack of protection. Most service providers operating in the cryptoasset industry do not currently operate in a regulated industry. Therefore, please be aware that when you buy cryptoassets, you are not protected under financial compensation schemes and protections typically afforded to investors when dealing with regulated and authorised entities to operate as financial services firm.