- Tokenized

- Posts

- Why Would Circle and Stripe Launch Their Own Chain?

Why Would Circle and Stripe Launch Their Own Chain?

The great L1 wars have just begun...

If you're reading this and still haven't signed up, click the subscribe button below!

Introduction

Welcome to the Tokenized newsletter, brought to you by the creators of the Tokenized Podcast; Simon Taylor of Fintech Brainfood and Pet Berisha of Sporting Crypto, written by Jeremy Batchelder.

We are the newsletter for institutions that need help preparing for a Tokenized future.

We run through the headlines every week, what it means for you and a market readout. Always with an institutional, business-focused perspective.

Join us every week as we meet your Tokenization needs.

Stories You Can't Miss 📰

🏗️ Stripe Building "Tempo" Blockchain with Paradigm

Fintech giant Stripe is developing a new payments-focused blockchain called "Tempo" in partnership with crypto VC firm Paradigm, according to a job posting discovered on the Blockchain Association's website.

Key Points:

Tempo is described as a "high-performance, payments-focused blockchain" currently in stealth mode with a team of five

The blockchain is Layer 1 (not built on other protocols) and EVM-compatible, allowing it to use Ethereum's coding language

Paradigm's Matt Huang, who sits on Stripe's board, is partnering on the development

The project is targeting Fortune 500 companies for marketing outreach

This follows Stripe's $1.1 billion acquisition of stablecoin infrastructure firm Bridge in October and crypto wallet developer Privy in June

The Tokenized Take:

Strategic vertical integration: Stripe is building a comprehensive stablecoin stack - Bridge for issuance APIs, Privy for wallets, and now Tempo for transaction processing infrastructure

Payments-specific design advantage: Unlike general-purpose chains like Solana or Base that handle everything from memecoins to DeFi, Tempo's payments focus could offer superior performance for financial use cases without network congestion from non-payment activities

Infrastructure play, not speculation: As Simon Taylor notes, this represents the missing "AWS for payments processing" - creating shared utility infrastructure that reduces operational overhead while moving competition to software rather than commodity processing

Race for the payment stack: This positions Stripe alongside Circle, Tether, and others in the competition to control critical layers of the emerging stablecoin payment infrastructure, with distribution through existing merchant relationships as a key advantage

🚀 Circle Launches Arc: Purpose-Built Blockchain for Stablecoin Finance

Circle has announced Arc, a new Layer-1 blockchain designed specifically for stablecoin-native applications, addressing enterprise pain points around predictable fees and treasury management.

Key Points:

USDC as native gas and instant finality: Arc eliminates volatile crypto gas fees by using USDC for transactions with predictable, dollar-denominated costs, while delivering sub-second settlement finality through the Malachite consensus engine

Built-in institutional FX infrastructure: The blockchain features an integrated RFQ system for price discovery and 24/7 peer-to-peer onchain settlement between stablecoins, plus opt-in privacy controls for enterprise compliance needs

Timeline and ecosystem integration: Arc enters private testnet in coming weeks, public testnet this fall, and mainnet beta in 2026, with full integration across Circle's platform including USDC, EURC, USYC, Circle Payments Network, and Cross-Chain Transfer Protocol

The Tokenized Take:

Solving real enterprise pain points: Circle directly addresses the top complaints from financial institutions - unpredictable gas fees, treasury teams unable to hold volatile crypto, and lack of enterprise support - with purpose-built solutions

Racing against Stripe's Tempo: Circle's Arc launch comes as Stripe develops its own payments-focused blockchain "Tempo," highlighting how major fintech players are converging on specialized payment infrastructure rather than general-purpose chains

Strategic positioning for stablecoin dominance: By creating infrastructure optimized specifically for stablecoins rather than retrofitting general-purpose blockchains, Circle is betting that specialized chains will capture enterprise adoption

🪙 Visa Doubles Down on Stablecoins as Strategic Growth Driver

Visa's head of crypto Cuy Sheffield is rapidly expanding the company's stablecoin business, positioning the payments giant as a bridge between traditional finance and digital currencies rather than viewing them as a threat.

Key Points:

Tokenized Asset Platform expansion: Visa's 2024-launched platform enables financial institutions to issue and manage blockchain tokens, with Spanish bank BBVA as a notable client creating tokens on Ethereum and live pilots expected this year

Seven-day stablecoin settlement: Visa's stablecoin settlement service allows clients to fulfill VisaNet obligations in stablecoins with 24/7 settlement capabilities, recently surpassing $200 million in cumulative volume

Global partnerships and emerging market focus: Recent deals include Rain (US stablecoin credit cards) and Yellow Card (African stablecoin payments), targeting regions where traditional banking access is limited

The Tokenized Take:

Smart defensive strategy: Rather than fighting stablecoins, Visa is embedding itself as essential infrastructure for fraud detection, compliance, and fiat conversion - services that remain necessary even in a stablecoin-native world

Land grab mentality: As analyst Richard Crone notes, Visa is "going after the land grab of empowering every possible stablecoin platform with payment capability" while the market is still nascent

Emerging market opportunity: With stablecoins potentially becoming the "default for international payments outside of the US," Visa's partnerships in Africa and other underbanked regions could unlock new addressable markets

💸 Stablecorner ⚖️ → Financial Privacy in the Age of Stablecoins

The conversation around stablecoins is evolving beyond just payments efficiency to fundamental questions about financial privacy and surveillance. In a recent episode of Tokenized, SEC Commissioner Hester Peirce delivered compelling insights on how digital assets could restore American values around financial privacy that have been eroded over decades.

"We at the SEC have a program now where we're monitoring what everybody is doing in the stock markets all the time... Just watching you in case you might do something wrong, you know, the idea is there's supposed to be a suspicion of guilt before they start following you around and watching you."

Commissioner Peirce's "peanut butter and watermelon" speech highlighted a crucial tension in modern finance: the government's increasing reliance on financial surveillance versus citizens' fundamental right to privacy. Traditional banking has created what she describes as a "treasure trove of information" flowing to government agencies through suspicious activity reports and data-sharing agreements, often with minimal standards for what constitutes "suspicious" activity.

Stablecoins present both opportunities and challenges in this privacy landscape. While most current stablecoins are issued by centralized entities that can freeze, seize, and monitor transactions, the underlying blockchain technology enables new forms of privacy protection. As Peirce explained: "You don't take your credit card bill and hand it to someone and say, hey, do you want to see what I spent, how many times I went to the store and bought chocolate?"

The paradox is evident: stablecoin transactions on public blockchains are completely transparent, yet the technology also enables privacy-protecting mechanisms like shielded transactions and zero-knowledge proofs. This creates opportunities for what Peirce calls "replicating cash in the digital world" - enabling peer-to-peer transactions without comprehensive surveillance while maintaining compliance capabilities through programmable money.

The regulatory approach emerging from the SEC emphasizes principles over prescriptive rules. Rather than mandating specific privacy or surveillance technologies, the focus is on enabling innovation while ensuring appropriate protections exist. This includes recognizing that privacy-protecting tools serve legitimate purposes for everyday citizens, not just bad actors seeking to evade detection.

As Commissioner Peirce noted, the goal isn't to eliminate all oversight, but to restore a presumption of privacy: "Let's embrace these privacy-protecting technologies because they really empower regular citizens to go about their everyday lives in ways that are safer and that are more privacy protecting and that's something that really goes to the fundamental dignity of a person."

📰 Some More News:

🏦 Tokenization, Stablecoins & Finance

Siemens digital bond traded on regulated trading venue 360X (Read more here)

BBVA provides off exchange custody for Binance – report (Read more here)

StanChart forms Hong Kong stablecoin JV with HK Telecom, Animoca (Read more here)

Fintech giant Stripe building ‘Tempo’ blockchain with crypto VC Paradigm (Read more here)

Plasma announce partnership with Pendle (Read more here)

Chainlink Teams Up With NYSE-Parent ICE to Bring Forex, Precious Metals Data On-Chain (Read more here)

RedotPay Launches Instant Fiat-to-Stablecoin Onramps in UK and European Union (Read more here)

Standard Chartered forms joint venture to issue stablecoins in Hong Kong (Read more here)

Paxos Applies for National Bank Trust Charter, Joining Stablecoin Issuers Circle, Ripple (Read more here)

Brazil’s DREX CBDC project pivots away from blockchain, tokenization (Read more here)

Korean financial firms sign partnerships in preparation for issuing stablecoins (Read more here)

🤑 Funding and M&A

💼 Government & Policy

EU crypto rules for banks unlock favorable tokenization treatment (Read more here)

Simon’s Market Readout 💬

A pixelated Simon gives you his market readout for the week.

While rumors of a very large payments company launching its own stablecoin focused blockchain are dominating some of the news and press cycle, we also saw that circle is launching its own stablecoin dedicated blockchain.

Immediately, you have to ask the question, why?

Aren’t there already enough blockchains?

Well, yes, there's plenty.

The problem is, I don't think we're done yet. I don't think we're done innovating, and I don't think that the blockchains we have are without their challenges and drawbacks.

Everything has drawbacks. Don't get me wrong, this isn't throwing shade at them, but as a payments business, maybe there are things that could be better. And as a payments company, you might wish to see that.

Circle’s white paper gives a lot of detail about what they think those features are going to be. They mentioned things like using USDC as the native gas token or fee token inside the network. This means that for a very large regulated financial institution, I no longer have to worry about buying some esoteric SOL or ETH thing, in order to just use the network. I can now use dollars. It's quite simple. Circle also talks about the fact that this is pre integrated with their cross-chain Bridge, their gateway, CCTP, and a lot of the things they're already trying to build out.

There's a bunch of other features that they've added too, like the ability to potentially ensure opt in privacy, but with a regulator view key.

What does that mean?

That means large regulated financial institutions could make capital markets trades without anybody knowing the balances of those trades and potentially being able to front run them into future trades, while still making sure that the regulator can see everything they're doing. But it's opt in, so you don't have to do that, and your default will be somewhat more private.

Fascinating example of an innovation that isn't as easily available in other blockchain networks. There are technical ways to make it work, but not as easily available… and I think that's the point.

What are all of these features that could be made more easily available? What are all of the features that are missing? I guess we don't know, but I think in the next six months we're going to find out.

What Circle has, and what other payments companies have, is distribution. Circle has Coinbase and binance, and Circle has an interesting challenge in which they give up most of their existing revenue to those companies, and they're facing into a market where their top revenue line from interest rates is set to come down slowly. So they need to expand their product into new areas, and they have a right to play and a right to win. Versus payments companies that have lots of existing distribution already and can potentially bring that to bear.

So this is going to be a fascinating couple of years in front of us, for sure.

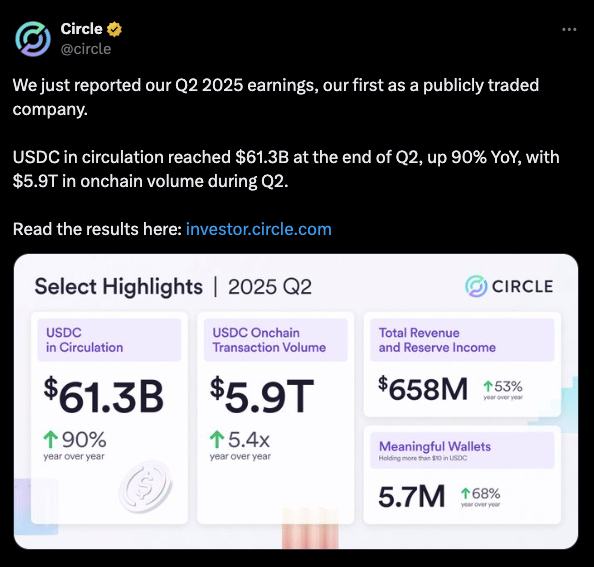

Tweet of the Week 🐤

From Circle

Thanks so much for reading the Tokenized Newsletter!

Please share this edition or share it with your colleagues if you enjoyed it!

Disclaimers

This newsletter is for informational purposes only and is not financial, business or legal advice. These thoughts & opinions and do not represent the opinions of any other person, business, entity or sponsor. Any companies or projects mentioned are for illustrative purposes unless specified.

The contents of this newsletter should not be used in any public or private domain without the express permission of the author.

The contents of this newsletter should not be used for any commercial activity, for example - research report, consultancy activity, or paywalled article without the express permission of the author.

Please note, the services and products advertised by our sponsors (by use of terminology such as but not limited to; supported by, sponsored by, Made Possible by or brought to you by) in this newsletter could carry inherent risks and should not be regarded as completely safe or risk-free. Third-party entities provide these services and products, and we do not control, endorse, or guarantee the accuracy, efficacy, or safety of their offerings.

It's crucial to provide our readers with clear information regarding the inherent nature of services and products that might be covered in this newsletter, including those advertised by our sponsors from time to time. When you buy cryptoassets (including NFTs) your capital is at risk. Risks associated with cryptoassets include price volatility, loss of capital (the value of your cryptoassets could drop to zero), complexity, lack of regulation and lack of protection. Most service providers operating in the cryptoasset industry do not currently operate in a regulated industry. Therefore, please be aware that when you buy cryptoassets, you are not protected under financial compensation schemes and protections typically afforded to investors when dealing with regulated and authorised entities to operate as financial services firm.